The Tax Impact

Explore financial information and the cost of the plan

Cook County Schools is committed to spending taxpayer dollars responsibly and making investments that our students, parents, staff and community members believe are important.

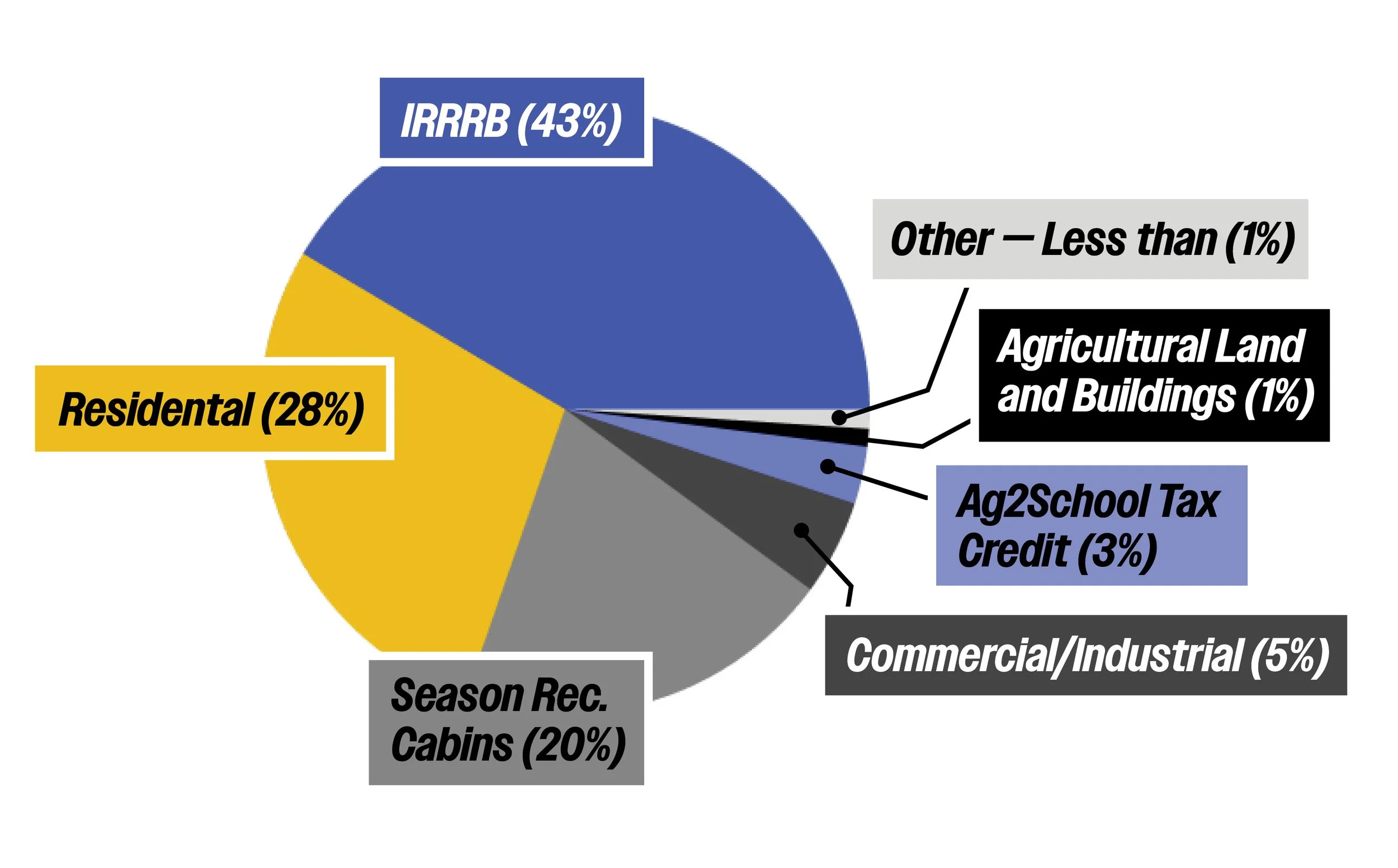

The total cost of the plan to improve our activities, performing arts, and outdoor learning spaces is $11.65 million. Thanks to the $5 million grant from the IRRRB, only $6.65 million would be paid by taxpayers over the length of the 20-year bond.

Estimated Tax Impact

If voters approve the referendum in November, a $400,000 home (approximately the district median) would see an estimated monthly tax impact of $4 per month starting in 2026.

By comparison, the approximate tax impact of comparable investments during last year’s referendum was $8 per month, for a property with the same value.

Determine your estimated tax impact using our tax calculator

You can instantly determine the projected tax impact of the referendum on your property using our referendum tax calculator. All you need is your parcel ID number.

Don’t know your parcel ID number? You can estimate your tax impact based on the value of your property using our referendum tax table below.

Frequently Asked Questions About The Tax Impact

-

If the referendum is rejected, the $5 million IRRRB grant will be lost. The grant is only available for this project, and future funding opportunities are not guaranteed.

-

Yes. In addition to the $5 million IRRRB grant, the district has been preapproved for an additional $250,000 grant through the Legislative-Citizen Commission on Minnesota Resources (LCCMR) to invest in outdoor learning spaces and walking paths. This grant requires a 25% match, which the referendum would provide, and is contingent upon final approval during the 2026 legislative session.